Asia Pacific Digital Health Market Size & Analysis, 2033

Asia-Pacific Digital Health Market Summary

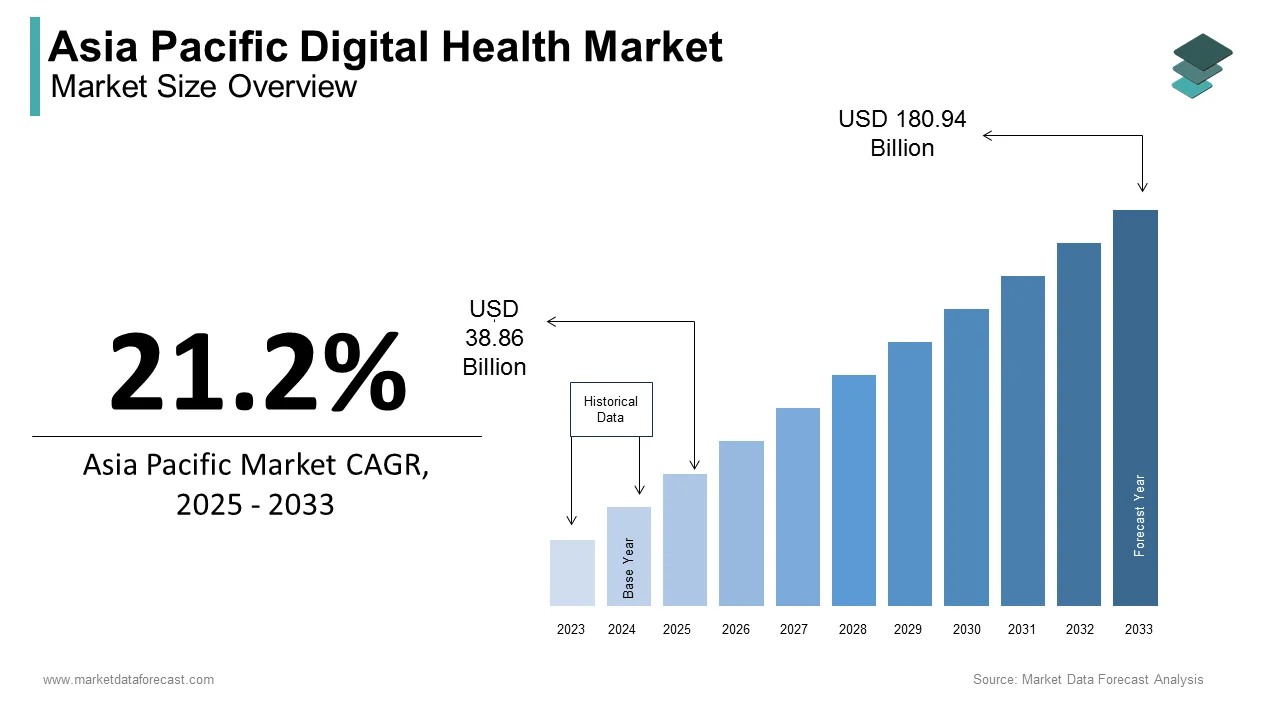

The Asia-Pacific digital health market size was valued at USD 32.06 billion in 2024 and is projected to reach USD 180.94 billion by 2033, growing at a CAGR of 21.2% from 2024 to 2033. The increasing use of telemedicine, wearable devices, and AI-driven platforms is transforming the region’s healthcare ecosystem.

Key Market Trends & Insights

- China accounted for the largest share of 30.2% in 2024.

- India held the second-largest market share with 18.6% in 2024.

- Based on technology, healthcare analytics dominated the market with a 58.3% share in 2024.

- Based on technology, the mobile health (mHealth) segment is projected to grow at the fastest CAGR of 23.7% from 2024 to 2033.

- Based on component, the software segment led the market with a 47.3% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.06 Billion

- 2033 Projected Market Size: USD 180.94 Billion

- CAGR (2025–2033): 21.2%

- China: Largest market in 2024

Asia Pacific Digital Health Market Size

The Asia Pacific digital health market is projected to grow from USD 32.06 billion in 2024 to reach USD 180.94 billion by 2033, at a CAGR of 21.2%.

Digital health is a wide range of technology-driven healthcare solutions, including telemedicine platforms, electronic health records (EHRs), mobile health applications, wearable medical devices, AI-enabled diagnostics, and cloud-based health data management systems. As per the International Telecommunication Union (ITU), Asia Pacific recorded over 70% internet penetration by 2024, facilitating the rapid adoption of digital health services. Countries like India, China, and Australia have launched national digital health initiatives to streamline patient care, reduce inefficiencies, and enhance preventive healthcare measures. Moreover, the aftermath of the global pandemic accelerated the acceptance of virtual consultations and remote monitoring tools. Governments and private stakeholders are investing heavily in scalable digital infrastructure to support aging populations, chronic disease management, and real-time epidemiological tracking.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The growing burden of chronic diseases such as diabetes, cardiovascular conditions, and respiratory illnesses is propelling the growth of the Asia Pacific digital health market. According to the World Health Organization, non-communicable diseases (NCDs) account for more than 60% of total deaths in the Asia Pacific region with countries like China and India witnessing sharp increases in lifestyle-related illnesses due to urbanization and changing dietary habits. Digital health technologies offer effective solutions for long-term disease monitoring and management, reducing hospital readmissions and improving patient outcomes. For example, in 2024, India’s Ministry of Health reported that over 100 million people suffer from diabetes, which is prompting increased adoption of glucose monitoring apps and connected wearables.

Government Initiatives and Policy Support

Another significant driver of the Asia Pacific digital health market is the proactive involvement of governments in promoting digital transformation within the healthcare sector. Several countries have launched comprehensive digital health strategies aimed at enhancing accessibility, affordability, and efficiency in healthcare delivery. For instance, China’s National Health Commission has prioritized the integration of big data and AI in public health planning, supporting the development of national telemedicine networks and centralized electronic health record systems. Similarly, India’s Ayushman Bharat Digital Mission (ABDM) aims to create a unified digital health ecosystem by assigning unique health IDs to citizens and linking them with healthcare providers and insurance schemes. Australia and Singapore have also made substantial investments in e-health infrastructure by ensuring seamless data exchange between hospitals, clinics, and pharmacies.

MARKET RESTRAINTS

Data Privacy and Cybersecurity Concerns

A major restraint affecting the Asia Pacific digital health market is the growing concern around data privacy and cybersecurity. According to a 2024 report by IBM Security, the healthcare sector experienced the highest average cost of a data breach globally, with Asia Pacific accounting for a significant portion of incidents due to inconsistent regulatory enforcement and fragmented compliance standards. Additionally, varying levels of data protection laws across countries such as strict regulations in Australia versus developing frameworks in Southeast Asian nations, create challenges for cross-border interoperability and standardization. Patients and providers remain cautious about adopting digital health tools without assurances of secure data handling.

These concerns act as a barrier to widespread implementation, necessitating stronger encryption protocols, regulatory harmonization, and investment in cybersecurity infrastructure to restore confidence and ensure sustainable growth in the digital health landscape.

High Implementation Costs and Infrastructure Gaps

Another key constraint limiting the expansion of the Asia Pacific digital health market is the high cost of implementing advanced digital solutions in low-income and rural areas where healthcare infrastructure remains underdeveloped. While large urban hospitals in countries like South Korea and Australia can afford cutting-edge digital tools, many smaller clinics and regional facilities struggle with budgetary constraints and outdated equipment. According to the Asian Development Bank, nearly 40% of healthcare facilities in Southeast Asia lack basic digital infrastructure, including reliable internet connectivity and electronic record systems. In countries like Indonesia and the Philippines, rural health centers often rely on manual documentation, making it difficult to integrate with national digital health networks. Furthermore, the deployment of AI-powered diagnostics, cloud-based EHRs, and IoT-enabled medical devices requires not only financial investment but also trained personnel and technical support. Many healthcare providers in the region face a shortage of skilled IT professionals capable of managing these complex systems.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Remote Consultation Services

One of the most promising opportunities in the Asia Pacific digital health market is the rapid expansion of telemedicine and remote consultation services. Enabled by advancements in broadband connectivity, mobile penetration, and AI-assisted diagnostics, telehealth platforms are bridging the gap between urban and rural healthcare access. According to the International Telecommunication Union, Asia Pacific surpassed 70% internet penetration by 2024 by allowing millions of previously underserved patients to access medical advice remotely. In India, the Ministry of Health reported that teleconsultations increased by over 60% between 2022 and 2024, which is driven by government support and private-sector innovations. Countries like Thailand and Malaysia have integrated telemedicine into national health programs, offering virtual consultations for chronic disease management and maternal health. Meanwhile, in China, platforms such as Ping An Good Doctor and WeDoctor have scaled their services to serve hundreds of millions of users by leveraging AI chatbots and video consultations.

Integration of Artificial Intelligence and Predictive Analytics

Another transformative opportunity in the Asia Pacific digital health market lies in the integration of artificial intelligence (AI) and predictive analytics into clinical decision-making, diagnostics, and population health management. These technologies enable faster diagnosis, personalized treatment plans, and early detection of diseases, thereby improving healthcare outcomes.

In Japan, for instance, AI-driven imaging analysis tools developed by Fujifilm and Hitachi are being deployed in hospitals to detect early-stage cancers with greater accuracy than traditional methods. According to the Japanese Society of Radiological Technology, AI-assisted diagnostics improved radiologists’ efficiency by 25% in 2024, by reducing diagnostic errors and workload pressures.

Similarly, in South Korea, the Ministry of Health and Welfare has backed AI-based drug discovery initiatives, accelerating pharmaceutical research and development. Startups in Singapore and Australia are also gaining traction with AI-powered triage systems and mental health chatbots designed to handle the rising demand for psychological services.

MARKET CHALLENGES

Regulatory Fragmentation Across Countries

One of the foremost challenges facing the Asia Pacific digital health market is the lack of uniform regulatory frameworks across countries, which complicates cross-border interoperability, data sharing, and compliance for multinational digital health providers. Each country has distinct legal requirements regarding data privacy, telemedicine licensing, device certification, and reimbursement models, creating operational complexities. For instance, Australia maintains stringent data protection laws under the Privacy Act 1988, while Indonesia’s digital health guidelines are still evolving, leading to inconsistencies in enforcement and implementation. This fragmentation discourages foreign investment and delays the adoption of standardized digital health solutions.

Resistance to Digital Adoption Among Older Healthcare Professionals

Another critical challenge impeding the growth of the Asia Pacific digital health market is the resistance to digital adoption among older healthcare professionals, particularly in rural and semi-urban settings. In China, the National Health Commission acknowledged that digital literacy gaps persist among frontline healthcare workers, especially in remote provinces where training resources are limited. Addressing this challenge requires targeted capacity-building programs, user-friendly interface design, and incentives for healthcare providers to embrace digital workflows.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Technology, Component, Application, End-use, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

Apple Inc., AirStrip Technologies, Google Inc., Orange, Allscripts Healthcare, LLC, Mckesson Corporation, Athenahealth Inc., At&T Inc., Biotelemetry, Inc., Cerner Corporation, Cisco Systems, Inc., Koninklijke Philips Nv, Eclinicalworks, Ihealth Lab, Inc., General Electric Company., and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

The healthcare analytics segment accounted in holding 58.3% of the Asia Pacific digital health market share in 2024. One key driver is the widespread adoption of predictive analytics in public health planning and hospital management. According to the World Health Organization, over 60% of hospitals in Australia and Japan have integrated advanced analytics tools into their electronic health records systems by enabling real-time monitoring of treatment outcomes and resource allocation. Additionally, governments across the region are leveraging healthcare analytics for epidemiological surveillance and pandemic preparedness. Moreover, private healthcare providers are using analytics for personalized medicine and risk stratification, particularly in managing chronic diseases like diabetes and cardiovascular disorders.

The mobile health (mHealth) segment is lucratively growing with an expected CAGR of 23.7% in the coming years. A major factor behind this growth is the surge in demand for remote health monitoring solutions, especially post-pandemic. According to the International Telecommunication Union, Asia Pacific achieved over 70% mobile broadband penetration by 2024 by enabling widespread access to teleconsultation apps, fitness trackers, and medication reminders. In India, the Ministry of Health reported that over 250 million users engaged with mHealth platforms in 2024, driven by government-backed initiatives such as the Ayushman Bharat Digital Mission. Furthermore, wearable integration with mHealth apps has enhanced user experience and adherence to health regimens.

By Component Insights

The software segment was the largest by occupying 47.3% of the share in 2024. One key driver is the growing preference for SaaS (Software-as-a-Service) models among hospitals and clinics, allowing scalable, cost-effective access to digital health tools without heavy upfront investment. Additionally, regulatory mandates in countries like Australia and Japan are pushing healthcare providers to digitize patient records and streamline workflows using certified software solutions. Moreover, the rise of AI-driven clinical decision support systems has further reinforced software’s dominant role.

The services segment is expected to grow with an expected CAGR of 21.4% during the forecast period. One major driver is the complexity associated with deploying and maintaining digital health solutions, particularly in developing economies where internal technical expertise may be limited. According to a 2024 Deloitte report, nearly 70% of healthcare providers in Indonesia and Vietnam outsourced digital transformation projects to specialized service providers to ensure compliance, scalability, and operational continuity. Additionally, governments are partnering with third-party service providers to implement national digital health frameworks. In India, the Ayushman Bharat Digital Mission leveraged services from Infosys and Tata Consultancy Services to develop and maintain its digital architecture, which is accelerating nationwide rollout and integration with existing health systems.

COUNTRY-LEVEL ANALYSIS

China Digital Health Market Insights

China was the top performer in the Asia Pacific digital health market with 30.2% of the share in 2024. One key growth driver is the Chinese government’s emphasis on digital health infrastructure under the “Healthy China 2030” strategy. In 2024, the National Health Commission expanded its national telemedicine network to include over 3,000 hospitals, significantly improving access to specialist consultations in rural areas. Simultaneously, domestic tech giants like Tencent and Alibaba have developed AI-powered diagnostic platforms and online consultation services, reaching hundreds of millions of users.

India Digital Health Market Insights

India’s digital health market held 18.6% of the share in 2024. A major catalyst is the Ayushman Bharat Digital Mission (ABDM), launched by the Ministry of Health and Family Welfare to create a unified digital health infrastructure. By mid-2024, over 400 million citizens had enrolled in ABDM, which is receiving unique health IDs linked to electronic medical records and insurance schemes. Simultaneously, startups like Practo, 1mg, and mfine have scaled teleconsultation services, catering to both urban and rural populations. Moreover, the expansion of 5G networks and digital literacy campaigns has enabled seamless access to healthtech services even in underserved regions.

Japan Digital Health Market Insights

Japan’s digital health market growth is likely to grow with a mature and technologically advanced healthcare system, where digital health solutions are increasingly being deployed to address challenges posed by an aging population and labor shortages in caregiving sectors. Additionally, Japan has been at the forefront of adopting robotics and IoT-based home healthcare devices. In 2024, Panasonic and SoftBank introduced AI-powered caregiving robots designed to assist elderly patients with mobility and daily activities, reflecting the convergence of digital health and assistive technologies. Telemedicine adoption has also increased significantly, particularly in remote islands and rural prefectures where physician availability is limited.

Australia Digital Health Market Insights

Australia digital health market growth is driven by its robust digital health governance, high healthcare expenditure, and widespread adoption of telehealth services, particularly following the acceleration seen during the pandemic. Additionally, telehealth utilization has remained high even after the pandemic, with Medibank Private Limited reporting that over 40% of general practitioner consultations in 2024 were conducted remotely, which is reflecting a lasting shift in healthcare delivery models. Private players like Telstra Health and Lifeblood Medical have invested heavily in cloud-based EMR systems and AI-driven diagnostics, further strengthening Australia’s digital health infrastructure.

South Korea Digital Health Market Insights

South Korea digital health market growth is due to its cutting-edge digital infrastructure, high smartphone penetration, and proactive government support for smart healthcare initiatives. Moreover, South Korea’s rapid adoption of telemedicine and mobile health apps has transformed patient engagement. Kakao Health and SK Telecom launched AI chatbots capable of triaging symptoms and recommending appropriate care pathways, serving millions of users across the country. Government incentives for startups in the healthtech space have also spurred innovation, with Seoul emerging as a hub for digital health incubation.

KEY MARKET PLAYERS

A few of the noteworthy companies operating in the Asia Pacific digital health market profiled in this report are Apple Inc., AirStrip Technologies, Google Inc., Orange, Allscripts Healthcare, LLC, Mckesson Corporation, Athenahealth Inc., At&T Inc., Biotelemetry, Inc., Cerner Corporation, Cisco Systems, Inc., Koninklijke Philips Nv, Eclinicalworks, Ihealth Lab, Inc., General Electric Company., and Others.

TOP LEADING PLAYERS IN THE MARKET

Fujifilm Healthcare (Japan)

Fujifilm Healthcare is a leading player in the Asia Pacific digital health market, known for its advanced medical imaging technologies and AI-powered diagnostic solutions. The company has been instrumental in transforming radiology through cloud-based PACS systems, AI-assisted image analysis, and integrated hospital information platforms. Fujifilm’s innovations support early disease detection and precision medicine, particularly in oncology and cardiology. Its focus on integrating artificial intelligence with traditional diagnostics has positioned it as a key contributor to the region’s digital health transformation.

Samsung Health (South Korea)

Samsung Health plays a pivotal role in shaping digital health trends across Asia Pacific through its ecosystem of wearable devices, mobile applications, and telehealth services. The company integrates hardware innovation with software analytics to offer personalized health monitoring and remote patient care. Samsung Health has expanded its footprint by collaborating with hospitals, insurers, and government bodies to deploy digital health platforms that enhance preventive care and chronic disease management. Its influence extends beyond consumer wearables into enterprise-level digital health infrastructure.

Ping an Good Doctor (China)

Ping an Good Doctor is a major force in China’s digital health landscape, offering a comprehensive online healthcare platform that connects patients with doctors, pharmacies, and diagnostic services. The company leverages AI catboats, virtual consultations, and big data analytics to deliver scalable and accessible healthcare solutions. It supports both urban and rural populations by bridging gaps in medical access through digital means.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Expansion through Strategic Partnerships and Collaborations leading digital health companies are forming alliances with hospitals, insurance providers, and technology firms to create integrated ecosystems that streamline patient care. These partnerships enable seamless data exchange, improve service delivery, and foster innovation through shared expertise and resources.

Investment in Artificial Intelligence and Predictive Analytics to enhance diagnostic accuracy and operational efficiency, key players are prioritizing AI-driven tools for clinical decision-making, disease prediction, and personalized treatment recommendations. These technologies not only improve patient outcomes but also reduce healthcare costs by optimizing resource utilization and minimizing errors.

Focus on User-Centric Mobile Health Solutions Companies are increasingly developing intuitive and accessible mobile health applications tailored to consumer needs. These apps facilitate remote consultations, medication tracking, and fitness monitoring, promoting proactive health management. The digital health providers are strengthening patient retention and expanding their reach across diverse demographics by enhancing user experience and engagement.

COMPETITION OVERVIEW

The competition in the Asia Pacific digital health market is intense and continuously evolving, driven by rapid technological advancements, increasing healthcare digitization, and rising demand for accessible and cost-effective medical services. Established multinational corporations compete alongside regional tech giants and emerging startups, each striving to capture market share through innovation, strategic expansion, and localized solutions.

Incumbent players leverage their strong brand presence, extensive distribution networks, and deep financial resources to maintain dominance. However, agile startups are disrupting the industry with niche offerings such as AI diagnostics, blockchain-enabled health records, and AI-powered wellness platforms tailored to specific population segments.

Government policies and regulatory frameworks further shape the competitive dynamics, influencing how quickly new entrants can scale and how existing players adapt to evolving standards. With increasing cross-border collaborations and digital health interoperability initiatives, the Asia Pacific region is witnessing a convergence of healthcare and technology, making it one of the most dynamic and fiercely contested markets globally.

RECENT MARKET DEVELOPMENTS

- In February 2024, Fujifilm Healthcare launched an AI-enhanced lung cancer screening module in collaboration with Japanese hospitals, which is aiming to improve early diagnosis and reduce radiologist workload across the country.

- In May 2024, Samsung Health announced a partnership with Singapore General Hospital to integrate its wearable health data into hospital electronic medical records by enabling real-time patient monitoring and better clinical decision-making.

- In July 2024, Ping an Good Doctor introduced a multilingual teleconsultation feature on its platform, allowing users in Southeast Asia to connect with Chinese physicians, thereby expanding its cross-border healthcare service capabilities.

- In September 2024, GE HealthCare expanded its cloud-based imaging analytics services in India, partnering with Apollo Hospitals to provide AI-supported diagnostics to rural clinics lacking specialist radiologists.

- In November 2024, Tata Digital Health, a subsidiary of Tata Consultancy Services, rolled out a nationwide digital health integration solution in India, which is linking public health centers with national databases under the Ayushman Bharat Digital Mission framework.

MARKET SEGMENTATION

This research report on the Asia-Pacific digital health market has been segmented and sub-segmented into the following categories.

By Technology

-

Tele-healthcare

-

mHealth

-

Digital Health Systems

-

Healthcare Analytics

By Component

- Software

- Hardware

- Services

By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

By End-Use

- Patients

- Providers

- Payers

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

link