Europe Mobile Application Market Size, Share & Growth, 2033

Europe Mobile Application Market Size

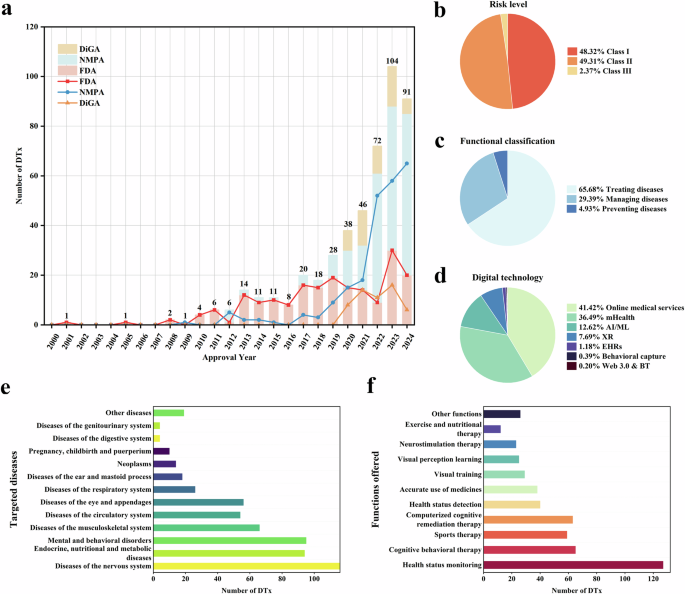

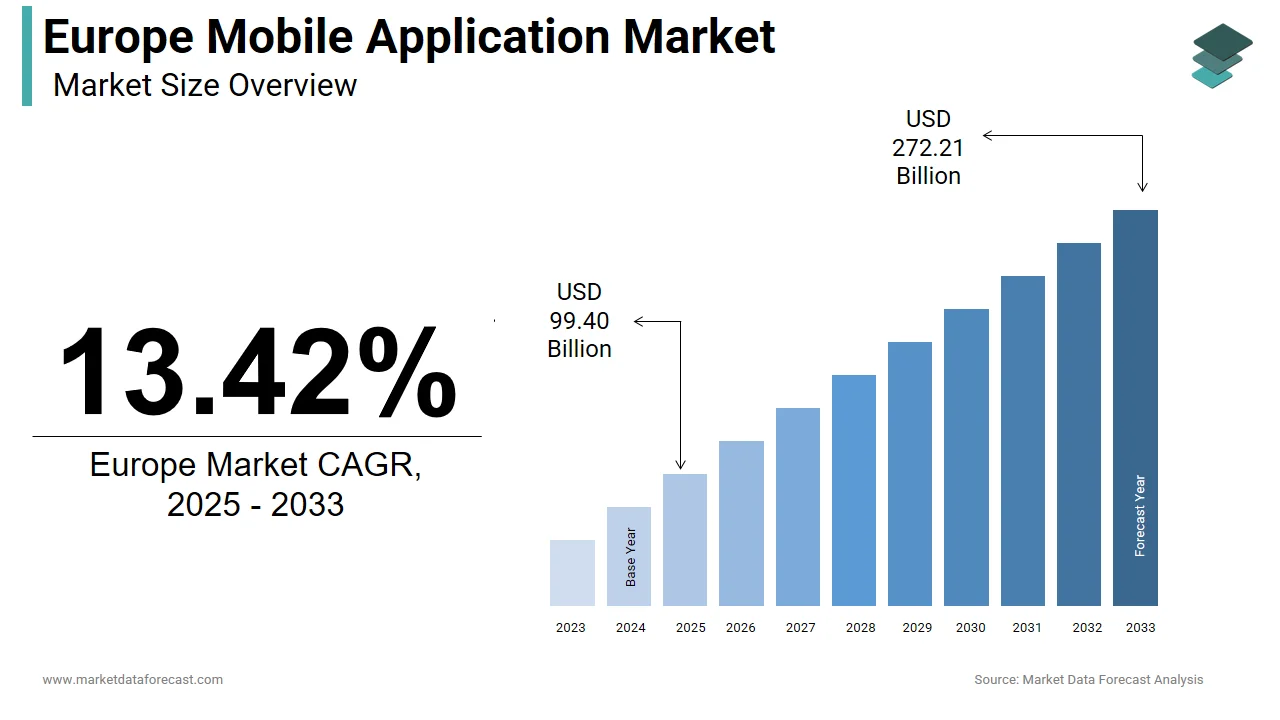

The Europe mobile application market was valued at USD 87.64 billion in 2024, is estimated to reach USD 99.40 billion in 2025, and is projected to reach USD 272.21 billion by 2033, growing at a CAGR of 13.42% from 2025 to 2033.

A mobile application is a software application designed for smartphones and tablets operating on iOS and Android platforms across consumer, enterprise, and public sector domains. These applications span diverse categories, including fintech, health tech e e-commerce, mobility, and government services, and are shaped by Europe’s unique regulatory, digital, and cultural landscape. Unlike markets driven solely by scale, Europe emphasizes data sovereignty, user privacy, and interoperability as core design principles. According to Eurostat data for 2023, approximately 9 out of 10 EU internet users accessed the internet using mobile devices (smartphones or mobile phones), which is 90% of internet users. As per sources, a notable share of EU citizens now interact with public services digitally, with mobile apps serving as primary interfaces for healthcare appointments, tax filing, and transport ticketing. The market operates within a stringent legal framework, including the Digital Services Act and the General Data Protection Regulation, which mandate transparency, algorithmic accountability, and user consent. This environment fosters innovation that prioritizes ethical design and user agency over pure engagement metrics.

MARKET DRIVERS

Widespread Adoption of Digital Public Services Is Accelerating Government-Backed Mobile App Development

European governments are actively migrating citizen services to mobile platforms to enhance accessibility, efficiency, and inclusion, driving sustained demand for secure and user-centric applications, which propels the growth of the European mobile application market. According to studies, a portion of EU citizens used online public services with mobile access, accounting for a portion of interactions in these countries. National initiatives exemplify this shift. These apps adhere to the EU’s Once Only Principle, which minimizes redundant data entry by securely reusing verified citizen information across agencies. The European Interoperability Framework further ensures cross-border functionality, enabling apps like the EU Digital COVID Certificate to operate seamlessly in all member states. This institutional push transforms mobile applications from convenience tools into essential civic infrastructure, reinforcing their strategic importance in public digital transformation.

Rising Demand for Embedded Financial Services Is Fueling Fintech Mobile App Innovation

Consumers and small businesses in the region increasingly expect financial capabilities to be seamlessly integrated into non-banking mobile applications, which in turn boosts the expansion of the Europe mobile application market. According to research, a share of adults in the euro area used mobile banking at least once a week, with a portion initiating payments directly from e-commerce or gig economy apps. This behavioural shift is enabled by the Revised Payment Services Directive, which mandates open banking APIs allowing third-party developers to offer payment lending and insurance features within their platforms. Moreover, ride-hailing platforms have embedded instant payout functions for drivers using real-time SEPA credit transfers. These integrations blur traditional sector boundaries and position mobile apps as primary financial touchpoints, particularly for digitally native demographics.

MARKET RESTRAINTS

Stringent Data Privacy Regulations Increase Compliance Complexity and Development Costs

Rigorous data protection regulations impose significant technical and administrative burdens on developers, which restrain the growth of the Europe mobile application market. The General Data Protection Regulation requires explicit user consent for data collection purposes, limitations, and data minimization principles that complicate standard app functionalities such as personalization and analytics. According to research, the number and magnitude of GDPR fines have increased significantly between 2021 and 2023, with major tech companies and their apps being a primary target for large penalties. These requirements disproportionately affect small studios lacking legal expertise, thereby raising barriers to entry and slowing innovation cycles in privacy-sensitive categories like health and finance.

Fragmented App Store Policies and Device Ecosystems Hinder Uniform User Experience

Divergent app store rules, device fragmentation, and national digital identity systems complicate deployment and maintenance, which constrains the expansion of the Europe mobile application market. Apple’s App Store and Google Play enforce different content moderation, monetization, and privacy standards, while the European Union’s Digital Markets Act now mandates alternative app stores on Android devices in the EU, creating additional distribution channels with inconsistent security protocols. As per sources, a portion of mobile apps tested displayed functional discrepancies between iOS, Android, and third-party Android stores, including broken payment flows or outdated security certificates. Furthermore, national eID schemes are not universally interoperable, forcing developers to integrate multiple authentication systems. This fragmentation inflates operational costs, reduces update frequency, and ultimately degrades user experience, particularly for cross-border services.

MARKET OPPORTUNITIES

Expansion of Green Digital Policies Is Creating Demand for Energy-Efficient Mobile Applications

The European Union’s Green Deal and upcoming Energy Efficiency Directive are driving demand for these applications (designed to minimize battery consumption, data traffic, and carbon footprint), and are setting up new opportunities for the Europe mobile application market. According to sources, digital technologies account for a share of the EU’s total greenhouse gas emissions, with mobile networks and devices contributing significantly. In response, the European Commission has developed or encouraged several codes and regulations related to digital services and data protection, but they focus on legal and ethical compliance. Companies are responding proactively. Startups offer certification for low-carbon apps based on real device telemetry. Energy-aware development, once a niche best practice, is now a competitive necessity as sustainability increasingly factors into the procurement decisions of public and corporate clients.

Growth of Cross-Border Digital Health Services Is Opening New Application Frontiers

The European Health Data Space initiative is enabling secure cross-national exchange of health records and is creating potential opportunities for the Europe mobile health applications market. As per sources, a portion of EU citizens now use mobile apps for health related purposes, including appointment booking, medication reminder, and teleconsultations. Besides, the EU’s cross-border telemedicine directive permits licensed practitioners to consult patients in other member states via certified apps. This regulatory harmonization transforms mobile health from isolated national tools into an integrated pan-European care platform, fostering innovation in remote monitoring, mental health, and preventive care.

MARKET CHALLENGES

Persistent Shortage of Skilled Mobile Developers Constrains Innovation and Scalability

Deficit in qualified software engineers proficient in modern frameworks, security protocols, and compliance requirements limits development velocity and product quality, which challenges the growth of the Europe mobile application market. According to studies, the EU will face a shortfall of ICT specialists in mobile development among the most affected domains. The gap is exacerbated by brain drain. While coding bootcamps have proliferated, they often lack alignment with industry needs. This talent crunch not only inflates wage costs but also forces startups to outsource core development, increasing security and intellectual property risks in a highly regulated environment.

Increasing Sophistication of Mobile Cyber Threats Impacts User Trust and Regulatory Compliance

Escalating cyber risks from malware, spyware, and supply chain compromises that jeopardize user data and violate stringent regulatory obligations impede the expansion of the Europe mobile application market. According to studies, mobile malware incidents targeting financial and health apps rose, with credential stealing and session hijacking as dominant tactics. The fragmented update ecosystem exacerbates vulnerability. Under the NIS2 Directive, app providers in critical sectors must now report breaches within 24 hours or face penalties of a share of global turnover. This high-stakes environment demands continuous security investment in code obfuscation, runtime protection, and penetration testing, resources often beyond the reach of small developers, thereby threatening the market’s innovation diversity and user confidence.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Store, Application, and Country. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Apple Inc., Google, Microsoft, Amazon.com, Inc., Gameloft, Netflix, Inc., Practo, cult.fit, Spotify Technology, Revolut Ltd, Ubisoft Entertainment, Xiaomi, and Zalando SE. |

SEGMENTAL ANALYSIS

By Store Insights

The Google Play Store segment dominated the Europe mobile application market by accounting for 62.4% share in 2024. The dominance of the Google Play Store segment is driven by the widespread adoption of Android devices across diverse income segments, particularly in Southern and Eastern Europe, where cost sensitivity influences purchasing decisions. Google’s open ecosystem also enables pre-installation agreements with manufacturers like Samsung, Xiaomi, and Oppo, which dominate European hardware sales. Furthermore, the Play Store’s support for multiple payment methods, including carrier billing and local e-wallets, enhances accessibility in markets with low credit card penetration. Regulatory alignment also plays a role; Google’s recent compliance with the Digital Markets Act by enabling third-party app stores on Android devices has reinforced its position as the default gateway while maintaining centralized security oversight through Play Protect. These structural and economic factors solidify Google’s dominance in Europe’s fragmented device landscape.

The other segment is predicted to witness the highest CAGR of 18.4% from 2025 to 2033 due to regulatory mandates and developer autonomy. Article 6 of the Digital Markets Act requires gatekeeper platforms like Apple and Google to allow sideloading and alternative app stores on devices sold in the EU. In response, companies such as Epic Games, Samsung, and Huawei have launched or expanded EU-specific storefronts. These platforms appeal to developers seeking reduced fees and greater control over user data and monetization. Furthermore, niche stores like Aptoide and Aurora Store cater to privacy-conscious users by offering open-source or ad-free alternatives. The alternative store ecosystem is set to reshape Europe’s app distribution model due to increasing consumer awareness and national regulators enforcing interoperability.

By Application Insights

The gaming segment held the leading share of 34.5% of the Europe mobile application market in 2024. The prominence of the gaming segment is attributed to advanced monetization models, including in-app purchases, battle passes, and live operations that generate recurring revenue from highly engaged users. The integration of cloud gaming and cross-platform play further deepens engagement. Regulatory acceptance also plays a role. Unlike some Asian markets, Europe permits loot boxes under consumer protection guidelines provided odds are disclosed, a framework adopted by some EU member states, as per sources. Apart from these, major franchises localize content for regional tournaments and cultural events, enhancing relevance. The segment’s resilience is evident in its performance during economic downturns; despite inflationary pressures, mobile gaming revenue in Europe grew, which reflects its entrenched position in digital leisure.

The health and fitness mobile application segment is estimated to register the fastest CAGR of 15.7% during the forecast period, owing to national health systems actively endorsing and integrating certified apps into clinical pathways. Germany’s Digital Health Applications Ordinance has approved many mobile apps for reimbursement through statutory health insurance, including offerings for diabetes management, mental health, and cardiac rehabilitation. Employer wellness programs further amplify adoption. These institutional endorsements transform health apps from lifestyle tools into clinically validated components of Europe’s preventive care strategy.

COUNTRY LEVEL ANALYSIS

United Kingdom Mobile Application Market Analysis

The United Kingdom was the top performer in the Europe mobile application market in 2024 and accounted for 18.1% share in 2024. Its concentration of venture capital talent and regulatory sandboxes that foster rapid prototyping propels the UK’s domination. London hosts a portion of Europe’s fintech unicorns, many of which deploy mobile-first banking and payment solutions used across the continent. The country’s strong creative industries also fuel entertainment and gaming development. Post Brexit, the UK has maintained GDPR aligned data rules, ensuring continued interoperability with EU markets while introducing its own Digital Markets Unit to promote competition. This balanced regulatory environment, combined with deep tech expertise in AI and cybersecurity, positions the UK as Europe’s most dynamic app ecosystem.

Germany Mobile Application Market Analysis

Germany followed closely in the Europe mobile application market and captured a 16.5% share in 2024. The growth of Germany is fuelled by its emphasis on data sovereignty, clinical validatio,n and industrial digitization. The country’s stringent interpretation of the General Data Protection Regulation has made it a testing ground for privacy by design architectur,es with apps achieving public trust. Germany’s Digital Healthcare Act has caused a certified app ecosystem where many mobile health applications are reimbursed by public insurers covering conditions from tinnitus to depression. Besides, Germany’s Industrie 4.0 initiative drives enterprise mobile app development for factory floor monitoring and supply chain coordination. This fusion of public health rigor and industrial pragmatism defines Germany’s high-integrity app landscape.

France Mobile Application Market Analysis

France is expected to be the most lucrative region in the Europe mobile application market, with state-led digital transformation and cultural policy that shape app development priorities. The government’s “France Num” initiative has digitized many public services into mobile accessible formats, including tax filing, school enrollment, and unemployment benefits. According to sources, a share of citizens aged 18 to 55 used a government app at least once per month. Simultaneously, France actively promotes linguistic and cultural sovereignty. The country also leads in mobility apps. This dual focus on administrative efficiency and cultural identity creates a uniquely localized yet scalable app environment.

Sweden Mobile Application Market Analysis

Sweden grew consistently in the Europe mobile application market due to its prominence in green coding, digital ethics, and inclusive design. The country’s tech ecosystem adheres to the Swedish Digital Agenda, which mandates energy efficiency and accessibility standards for publicly funded apps. Swedish developers also prioritize low carbon footprints. Furthermore, Sweden’s Innovation Agency Vinnova has funded startups building apps for circular economy sharing platforms and mental health, with a focus on algorithmic transparency. The nation’s high digital literacy creates a receptive user base for responsible innovation. This values-driven approach positions Sweden as a benchmark for human-centric app development.

Netherlands Mobile Application Market Analysis

The Netherlands is predicted to expand in the Europe mobile application market from 2025 to 2033 because mobile solutions are deeply embedded in smart city systems and global trade networks. Dutch ports, airports, and logistics hubs rely on custom mobile apps for real-time cargo tracking, customs clearance, and driver coordination. The country’s progressive stance on digital identity enables seamless authentication. Furthermore, the Netherlands hosts Europe’s largest data traffic hub, facilitating low-latency app performance. This infrastructure-first mindset transforms mobile applications from standalone tools into operational layers of national efficiency and connectivity.

COMPETITIVE LANDSCAPE

The Europe mobile application market features a dynamic interplay between global tech giants, regional champions, and agile startups, all operating under a uniquely stringent regulatory regime. Competition is no longer solely based on user acquisition or feature richness but increasingly on trust, transparency, and public value. Large platforms must navigate the Digital Services Act and General Data Protection Regulation, which limit data exploitation and mandate algorithmic accountability. Meanwhile, European-born companies leverage cultural proximity, regulatory fluency, and public sector collaboration to carve defensible niches in fintech, healthtech, and civic services. Startups benefit from EU-funded innovation programs but face high compliance costs and talent shortages. The enforcement of the Digital Markets Act has further disrupted traditional app store monopolies, enabling alternative distribution models. This environment rewards companies that balance innovation with ethical design, public utility, and cross-border interoperability, creating a market where technical excellence must coexist with social responsibility.

KEY MARKET PLAYERS

Some of the companies that are playing a dominating role in the Europe mobile application market include

- Apple Inc.

- Microsoft

- com, Inc.

- Gameloft

- Netflix, Inc.

- Practo

- cult.fit

- Spotify Technology

- Revolut Ltd

- Ubisoft Entertainment

- Xiaomi

- Zalando SE

TOP PLAYERS IN THE MARKET

- Spotify Technology is a defining force in the Europe mobile application market with its audio streaming platform serving as a benchmark for personalized content delivery and user experience. Headquartered in Sweden, the company has shaped global mobile engagement models through algorithm-driven discovery playlists and offline listening capabilities. Spotify contributes to the global ecosystem by pioneering lean data usage techniques and accessibility features now adopted industry-wide. Recently, the company enhanced its mobile app with real-time lyrics synchronization and AI-powered wellness soundscapes tailored to European sleep and focus patterns. It also deepened integration with national public broadcasters in Germany and France, enabling seamless access to local podcasts. These initiatives reinforce Spotify’s role as both a cultural curator and a technical innovator in Europe’s mobile landscape.

- Zalando SE operates as a leading mobile commerce player across Europe, offering a fashion and lifestyle platform optimized for on-the-go shopping. Based in Germany, the company has transformed mobile retail through visual search, augmented reality, fitting rooms, and same-day delivery tracking. It also introduced carbon footprint labels for every product viewable in the app, aligning with EU sustainability directives. These features position Zalando not just as a retailer but as an enabler of digital transformation for Europe’s fashion SMEs.

- Revolut Ltd has redefined financial mobile applications in Europe by consolidating banking, payments, currency exchange, and investment services into a single intuitive interface. Founded in the United Kingdom, the fintech firm has driven global adoption of embedded finance through its mobile-first architecture. Revolut actively shapes regulatory dialogue by participating in European Commission working groups on open banking and digital identity. It also integrated real-time SEPA instant payments with dynamic currency conversion. These developments emphasize Revolut’s dual role as a consumer app leader and infrastructure contributor to Europe’s digital finance ecosystem.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the Europe mobile application market employ several strategic approaches to maintain dominance and ensure regulatory alignment. They prioritize privacy by design, architecture, embedding data minimization and user consent mechanisms directly into app code. Localization goes beyond language to include regional payment methods, cultural aesthetics, and compliance with national digital identity schemes. Companies invest heavily in energy-efficient coding and low data consumption features to meet EU green digital standards. Strategic partnerships with public institutions enable integration into national health transport and administrative ecosystems. Apart from these, firms actively engage with regulators through policy dialogues to shape emerging frameworks like the Digital Markets Act and AI Act, ensuring their products remain both innovative and compliant in a rapidly evolving legal landscape.

MARKET SEGMENTATION

This research report on the Europe mobile application market has been segmented and sub-segmented into the following categories.

By Store

- Google Store

- Apple Store

- Others

By Application

- Gaming

- Music & Entertainment

- Health & Fitness

- Social Networking

- Retail & E-commerce

- Travel & Hospitality

- Learning & Education

- Others

By Country

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe

link