mHealth Apps Market Size, Share & Global Growth Report [2032]

![mHealth Apps Market Size, Share & Global Growth Report [2032] mHealth Apps Market Size, Share & Global Growth Report [2032]](https://www.fortunebusinessinsights.com/img/featured_images)

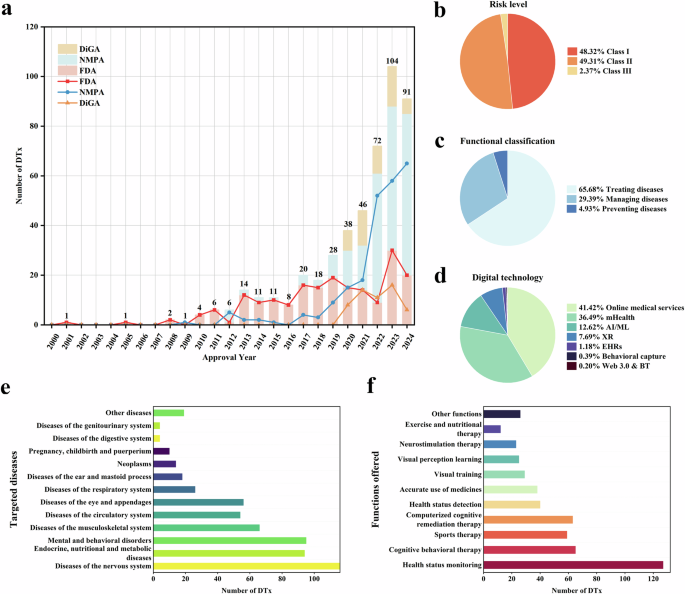

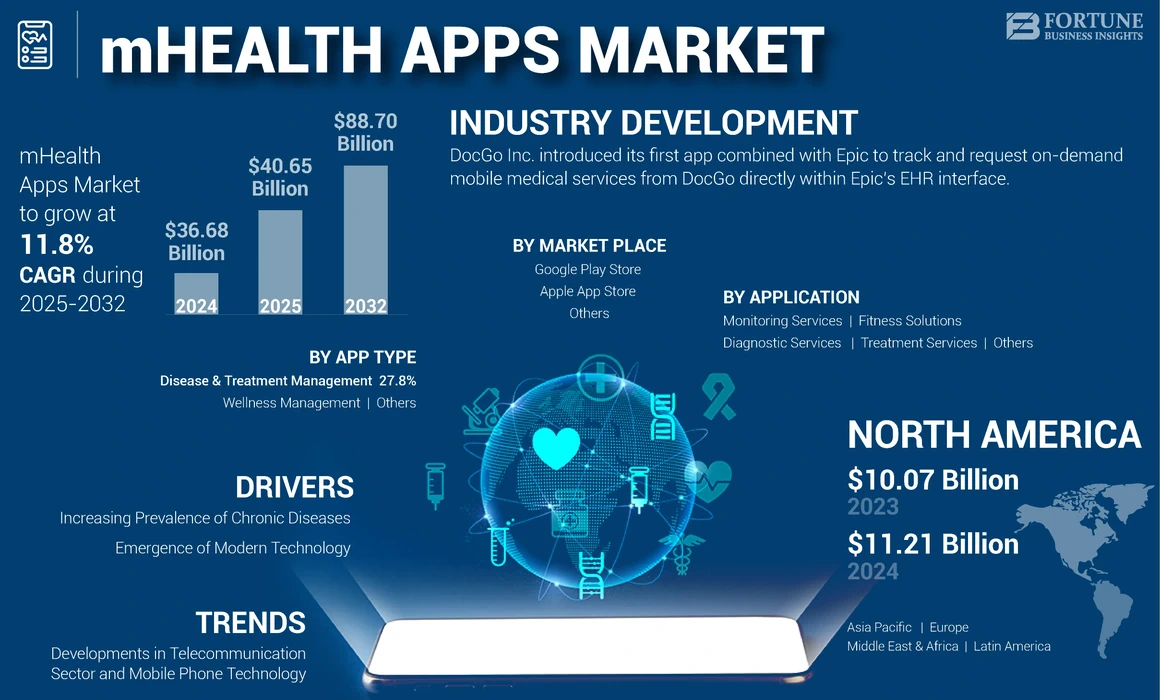

The global mHealth apps market size was USD 36.68 billion in 2024. The market is projected to grow from USD 40.65 billion in 2025 to USD 88.70 billion by 2032, exhibiting a CAGR of 11.8% during the forecast period. North America dominated the mHealth apps market with a market share of 30.56% in 2024.

mHealth or mobile health involves sharing and monitoring health information via mobile technology, such as health tracking apps and wearables. Using mobile wireless technology to deliver care and monitor symptoms allows medical professionals to make diagnoses easier and more efficient, with minimal errors. mHealth is gaining traction among customers as tech giants, such as Google and Apple continue to provide various applications on their app stores.

The market is estimated to experience significant growth during the forecast period owing to rising consumer demand for accurate health monitoring solutions, allowing pharmaceutical and mobile health app companies to develop mHealth apps. A few of the top apps are Fitbit, Apple Heart Study, BlueStar, and others. Healthcare providers can reduce appointment costs by utilizing mHealth apps that lower the risk of patient rehabilitation. Patients can utilize these types of apps for medication reminders and recovery instructions instead of staying in a medical facility post-surgical discharge. For instance, in January 2023, Omada Health partnered with Castell and Intermountain Healthcare. This collaboration aimed to expand access to Omada’s Diabetes Prevention Program and Diabetes Program to patients and caregivers under Intermountain Healthcare’s primary care providers in its Utah Medical Group.

The increasing usage of such apps is a significant factor contributing to the market growth. These apps provide opportunities to record health-related data, monitor health, conduct online consultations, manage chronic conditions, and offer other features. Moreover, increasing concerns among the population about their health is another important factor boosting the adoption of such technology, driving the global mHealth apps market growth.

The COVID-19 pandemic had a positive impact on the market due to high download rates and product launches in 2020. Furthermore, in 2021, the adoption rate of mHealth apps rapidly increased as investments in these digital tools were growing. The usage of these apps increased considerably since 2020 and this trend is expected to continue throughout the forecast period.

Global mHealth Apps Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 36.68 billion

- 2025 Market Size: USD 40.65 billion

- 2032 Forecast Market Size: USD 88.70 billion

- CAGR: 11.8% from 2025–2032

Market Share:

- Region: North America dominated the market with a 30.56% share in 2024. The region’s leadership is due to the presence of the highest percentage of major health app companies, increasing internet penetration, and a rising prevalence of chronic conditions linked to sedentary lifestyles.

- By App Type: The Wellness Management segment is expected to hold the largest market share. This dominance is driven by an increasing trend among the population to remain fit and healthy, coupled with the growing global incidence of obesity, which fuels the demand for fitness, diet, and nutrition apps.

Key Country Highlights:

- Japan: The market is influenced by major domestic players such as Omron Healthcare, Inc., which is actively innovating with new FDA-authorized technologies like AI-powered atrial fibrillation (AFib) detection in its devices and expanding its digital health footprint through strategic acquisitions.

- United States: Growth is fueled by the high prevalence of chronic diseases like coronary heart disease, which necessitates continuous monitoring. The market is also supported by a robust ecosystem of health app companies and strategic partnerships, such as those between Omada Health and major healthcare providers, to expand patient access to digital programs.

- China: As a key country in the fastest-growing Asia Pacific region, China’s market is expanding due to rising disposable incomes, higher healthcare expenditure, and a burgeoning start-up scene introducing a variety of new and localized mHealth applications.

- Europe: The market is propelled by significant government investment in digital infrastructure, such as the European Commission’s NextGenerationEU recovery package that supports 5G development. Additionally, national initiatives, like the U.K. National Health Service’s (NHS) digital health portal for validating health apps, are increasing user trust and adoption.

mHealth Apps Market Trends

Rapid Developments in Telecommunication Sector and Mobile Phone Technology to Surge Product Demand

Prompt advancements in the telecommunication sector, such as the introduction of 4G LTE provided various opportunities for the mHealth industry to flourish. Owing to the introduction of such technologies, developing countries that lack access to proper communication capabilities will have the opportunity to experience an enhanced network facility. They can also witness the benefits of using these apps. For instance, in October 2022, the next-generation 5G network service was introduced by Prime Minister Narendra Modi at the sixth edition of the India Mobile Congress (IMC) in India. The introduction of such faster network capabilities will enable the mHealth industry to provide a better experience for their patients, thereby boosting product demand. Hence, such advancements will strongly support market growth during the forecast period.

mHealth apps continue to evolve with advancements in mobile phone technology and telecommunications. These advancements have resulted in the development of easily accessible apps, which are being extensively used by the patient population. In June 2021, the Digital Medicine Society launched a collaborative community called the Digital Health Measurement Collaborative Community (DATAcc) to develop best practices for measuring health through mHealth platforms. These partnerships with telecommunication providers are expected to bolster the healthcare ecosystem and promote the use of mHealth apps.

Request a Free sample to learn more about this report.

mHealth Apps Market Growth Factors

Increasing Prevalence of Chronic Diseases to Propel Market Growth

One of the most crucial drivers of this market is the rising prevalence of chronic disorders across the globe. Chronic diseases, such as respiratory ailments, cardiac conditions, diabetes, and hypertension have led to the maximum adoption of such apps.

- For instance, as per statistics published by the Centers for Disease Control and Prevention (CDC) in 2023, coronary heart disease was the most common heart disorder in the U.S. and killed about 375,476 people in 2021.

Hence, such ailments require continuous monitoring or regular checkups with medical professionals. These apps play a major role in managing such conditions by offering remote patient monitoring features and frequent medication reminders to help patients manage their health routine and eliminate the need for physical visits to a specialist. These benefits associated with health apps will strongly support the mHealth apps market growth during the forecast period.

Emergence of Modern Technology to Drive Market Progress

The emergence of novel technology and increasing demand for more effective mHealth apps are significant factors driving market growth. Moreover, European countries are trying to develop several other innovative technologies to enhance the features of mobile health apps.

- For instance, in June 2019, the U.K. National Health Service (NHS) announced the launch of a digital health portal to allow its experts to validate and review health apps as they were being developed for the agency’s app library. Moreover, rising demand for these apps among the population owing to increasing awareness of the benefits associated with innovative apps will further augment market growth.

RESTRAINING FACTORS

Technological Barriers In Developing Countries and Lack of Reliable Digital Infrastructure to Impede Market Development

Despite the huge potential of mobile health apps, technological, and infrastructural barriers are some of the major factors inhibiting the expansion of the market in developing countries. Adopting health apps requires deploying the latest telecommunication devices, high-speed internet with high bandwidth, and large storage capacity for the integration and transmission of medical data. These resources are still lacking in many developing countries, thereby hindering market expansion.

- According to a 2022 news article published by India Today, there are 5.97 lakh villages in India out of which 25,000 villages still do not have mobile or internet connectivity. Such barriers in developing countries are expected to restrict the market growth during the forecast period.

mHealth Apps Market Segmentation Analysis

By App Type Analysis

Wellness Management Segment to Dominate Owing to Rising Health Consciousness

On the basis of app type, the market is segmented into disease & treatment management, wellness management, and others.

The wellness management segment is likely to hold the maximum market share over the forecast period due to the increasing trend among the population to remain fit and healthy. Moreover, the growing incidence of obesity in various countries is another important factor fostering the market expansion. The rising trend of a sedentary lifestyle and shortage of physical activities have increased the incidence of obesity in both men and women across the globe, contributing to market growth.

The disease & treatment management segment is estimated to showcase lucrative growth opportunities during the forecast period. High segment growth is attributed to the increasing prevalence of chronic diseases across the globe. Moreover, technological advancements in health apps to eliminate communication barriers between patients and doctors are another important factor contributing to the segment’s growth. Rising concerns among people about their health will further escalate the demand for mobile health services during 2025-2032. For instance, in January 2024, Omada Health partnered with Amazon Health Services to increase awareness and discoverability of its cardiometabolic programs through Amazon’s new Health Condition Programs.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Monitoring Services Segment to Dominate Owing to Increasing Geriatric Population

On the basis of application, the global market is segmented into monitoring services, fitness solutions, diagnostic services, treatment services, and others.

The monitoring services segment is anticipated to hold the maximum mHealth apps market share during the forecast period. This is primarily due to the increasing rate of the geriatric population suffering from chronic ailments that require continuous monitoring. For instance, as per an article published by the National Council of Aging (NCOA) in April 2021, approximately 80% of adults aged 65 and over had at least one chronic disease, while 68% had two or more. Hence, this factor will strongly support the adoption of mhealth apps for frequent health monitoring, thus augmenting the segment growth.

The fitness solutions segment is estimated to witness lucrative growth during the forecast period due to increasing demand for fitness and wellness apps among millennials. The rising trend of maintaining a healthy body has influenced people to follow diets and maintain regular exercise routines. Mobile health apps assist people in following such habits with punctual reminders and appropriate diet plans. Hence, the factors mentioned above have considerably supported the segment’s growth.

By Market Place Analysis

Rising Investments by Health Tech Companies to Boost Google Play Store Segment Growth

Based on market place, the market is segmented into google play store, apple app store, and others.

The google play store segment is anticipated to hold a dominant share over the forecast period as an increasing number of health app companies are investing in the platform. Moreover, the increasing smartphone penetration rate across developed and developing economies will further propel the segment’s growth. The rising technological advancements in Android apps are another important factor supporting the segment’s expansion during the forecast period.

The apple app store as an operating system platform for mobile health apps is anticipated to hold the second-largest market share due to the increasing sales of iPhones, specifically in the U.K. Hence, the growing penetration rate of smartphones and other smart medical devices equipped with health apps will support the segment’s growth. Furthermore, high standards of privacy and curated content are anticipated to fuel the growth of the segment.

REGIONAL INSIGHTS

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America mHealth Apps Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

North America generated a revenue of USD 11.21 billion in 2024 and is expected to remain dominant in the global market during the forecast period. The U.S. is one of the top countries with the highest percentage of major health apps companies operating in the industry. The increasing internet penetration rate across various states in the U.S. will significantly impact market growth. Additionally, an increase in sedentary lifestyles due to busy job schedules has led to a rise in the prevalence of several chronic conditions in the U.S. Hence, the factors mentioned above have significantly boosted the demand for mHealth applications, thereby fostering the regional market growth over the forecast period.

Europe recorded significant revenue in the global market in 2024. The growth of this region is attributed to factors, such as increased research funding by governments to enhance the accessibility of digital technologies. In 2020, the European Commission agreed to offer a recovery package called NextGenerationEU (NGEU) to increase investment in 5G development. This package comprised USD 930 billion in loans and grants. In the same year, the global mobile traffic alone had reached a value representing 33 times increase compared to the 2010 figures. Through such initiatives, wireless devices, such as smartphones, tablets, machines, and sensors dominated the telecommunication industry, thereby augmenting the regional market growth.

The Asia Pacific market is expected to witness the highest growth in its value owing to increasing disposable incomes across the region, leading to higher healthcare expenditure. Furthermore, as smartphones have opened new opportunities for mHealth, many apps, such as Medeel, Yton, DocDoc, ConnectedHealth, and ScolioTrack from start-up companies are being introduced in Asia Pacific, in turn augmenting the regional market growth.

Latin America and the Middle East & Africa markets are witnessing notable growth due to an increase in chronic diseases, which may require additional patient monitoring.

Key Industry Players

Market Players to Focus on Novel Product Launches to Hold Strong Foothold in Market

In terms of competitive landscape, the global market is highly fragmented with various national and international players. Owing to this market’s potential, many new start-up companies are entering the market in this digital transformation era. The tier 1 companies, such as FitBit. Inc., Google, Apple, Omron Healthcare Inc., Under Armour Inc., Fitness Keeper, Auzmio, Virtuagym, and others, account for the leading position. Top ratings for these apps and a huge number of subscribers across the globe are the major factors helping these companies to stay dominant in the market. In October 2022, Apple Inc. launched an updated version of Apple Fitness+ with a subscription service with an aim to strengthen its market position.

List of Top mHealth Apps Companies:

KEY INDUSTRY DEVELOPMENTS:

- November 2024 – FDA Authorization for AI-Powered AFib Detection

Omron received FDA De Novo authorization for its home blood pressure monitors equipped with AI-driven atrial fibrillation (AFib) detection. The IntelliSense™ AFib algorithm analyzes pressure pulse waves during measurement, aiming to enhance early AFib detection and reduce stroke risk. - April 2024 – Acquisition of Luscii for Remote Patient Monitoring

Omron acquired Luscii, a European remote patient monitoring service provider. This move strengthens Omron’s presence in digital health, offering care plans based on home-measured biometric data across over 150 diseases, including cardiovascular and respiratory conditions. - October 2024 – Launch of Apple Watch Series 10 with Health Features

Apple introduced the Apple Watch Series 10, featuring advanced health monitoring capabilities, including hearing health assessments and sleep apnea detection, enhancing its wearable health technology offerings. - April 2024 – Significant Reduction in Greenhouse Gas Emissions

Apple announced a 55% reduction in greenhouse gas emissions since 2015, achieved through innovations in clean energy, materials, and recycling, as part of its commitment to environmental sustainability. - January 2025 – FDA Approvals for Innovative Medical Devices

Abbott received FDA approval for several medical devices, including the TriClip™ TEER system for tricuspid valve repair, the i-STAT® TBI cartridge for traumatic brain injury assessment, and Lingo™, a non-prescription continuous glucose monitoring system aimed at general wellness.

REPORT COVERAGE

The global mHealth apps market report provides a detailed analysis as it focuses on key aspects, such as leading companies, app type, applications, and marketplaces. Additionally, it offers insights into the market trends, impact of COVID-19, statistics on smartphone penetration rate in key countries, internet users, and penetration statistics, among other key insights. Moreover, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Request for Customization

Report Scope & Segmentation

|

ATTRIBUTE

|

DETAILS

|

|

Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Estimated Year

|

2025

|

|

Forecast Period

|

2025-2032

|

|

Historical Period

|

2019-2023

|

|

Growth Rate

|

CAGR of 11.8% from 2025 to 2032

|

|

Unit

|

Value (USD Billion)

|

|

Segmentation

|

By App Type

|

|

By Application

|

|

|

By Market Place

|

|

|

By Region

|

link